The Federal Reserve on Wednesday said that it would start buying short-dated government bonds to help manage market liquidity levels to ensure the central bank retains firm control over its interest rate target system.

The technically oriented purchases will commence on December 12, the central bank said as part of the policy announcement associated with its latest Federal Open Market Committee meeting. When it begins buying, the initial round will total around $40 billion in Treasury bills.

The Fed said in a statement that its buying "will remain elevated for a few months to offset expected large increases in non-reserve liabilities in April," adding, "after that, the pace of total purchases will likely be significantly reduced in line with expected seasonal patterns in Federal Reserve liabilities."

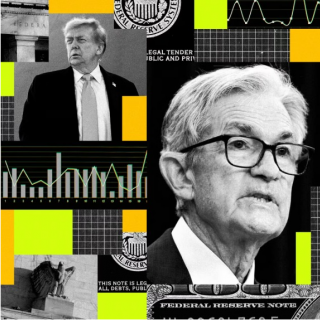

Speaking after the Fed meeting, Fed Chair Jerome Powell said the buying is "solely for the purpose of maintaining an ample supply of reserves over time, thus supporting effective control of our policy rate." He added, "these issues are separate from and have no implications for the stance of monetary policy."

The restart of bond buying that will once again expand the Fed's balance sheet comes hot on the heels of its decision to stop shrinking its holdings as of the start of the month.

Since 2022, the central bank had been allowing Treasury and mortgage bonds it owns to mature and not be replaced, in an effort called quantitative tightening, or QT.

The effort was aimed at draining the oceans of liquidity the Fed added during the COVID-19 pandemic to stabilize markets and provide stimulus in a time of near-zero rates. QT took the overall size of the Fed's balance sheet from $9 trillion in 2022 to its current size of $6.6 trillion.

The Fed announced an end to QT in late October amid increasing signs that liquidity had tightened enough to potentially complicate the management of the central bank's federal funds rate, its main tool to achieve its inflation and employment goals.

In October, key money market rates began drifting higher as some financial firms tapped in size the Fed's Standing Repo Facility, which provides fast loans collateralized with Treasury and mortgage bonds. That portended a potential loss of control over the federal funds rate, spurring the Fed to end QT.

INEXACT SCIENCE

Between the announcement of QT's end and its actual conclusion, Fed officials cautioned that they'd soon need to rebuild liquidity. The Fed is seeking to maintain what it views as an "ample" level of liquidity that keeps the federal funds rate in its range while allowing for normal money market volatility.

A number of analysts had expected a swift shift to renewed asset buying, although many had been projecting sometime early next year as a starting point. The Fed's move to expand holdings again may be a move to bolster liquidity over the end of the year, which can often bring large levels of short-lived money market volatility.

New York Fed President John Williams said on November 12 that the analysis to determine when reserves reach ample levels is an "inexact science." He said once the desired level of reserves is achieved "it will then be time to begin the process of gradual purchases of assets," noting this type of buying "in no way represents a change in the underlying stance of monetary policy."

Speaking on the same day, Roberto Perli, who manages the implementation of monetary policy at the New York Fed, said "given what we know today we probably won't have to wait long" before the expanded buying kicks off.

Source: Investing.com

Stephen Miran, a Federal Reserve governor whose term ends at the end of January, said Thursday that he is looking for 150 basis points of interest-rate cuts this year to boost the U.S. labor market. ...

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined significant changes to bank supervision and regulation during a speech at the California Bankers Association Bank Presidents Seminar...

Further changes to the Federal Reserve's short-term interest rate will need to be "finely tuned" to incoming data given the risks to both the U.S. central bank's employment and inflation goals, Richmo...

Richmond Federal Reserve Bank President Tom Barkin said the monetary policy outlook remains in a fragile balance given the conflicting pressures of rising unemployment and persistently high inflation....

The US Federal Reserve agreed to cut interest rates at its December meeting only after a highly nuanced debate about the current risks facing the US economy, according to minutes from the two-day meet...

Oil prices stabilized on Thursday (February 12th), as the market reassigned a risk premium to US-Iran tensions despite US inventory data showing swelling domestic supplies. This movement confirms one thing: geopolitical headlines are still more...

Gold prices weakened slightly on Thursday (February 12th), as more solid US employment data reduced market confidence in an imminent Federal Reserve interest rate cut. The strong employment data prompted market participants to shift expectations of...

The Hang Seng Index reversed its downward trend in Hong Kong on Thursday (February 12th), weakening by around 0.9% to around 27,000 after a strong session earlier. This decline halted the momentum of the short term rally, as investors began to...